Sales tax is a type of tax imposed on the sale of goods and services. The seller is responsible for collecting sales tax and it’s typically a percentage of the purchase prices added to the final cost.

Time for everyone’s favorite topic: taxes!

Still with us? If you’ve just launched your new business and are ready to start making sales, you might be asking yourself, “Do I need to charge sales tax?”

Knowing whether you need to charge sales tax is—no surprise—pretty complex. Especially when sales tax laws make for dry reading and can differ from state to state. Still, understanding your tax obligations is crucial for small businesses and retailers—and it doesn’t need to be quite as baffling as you might think.

In this guide, we’ll help you understand when to charge sales tax, including how much sales tax you need to collect depending on your state.

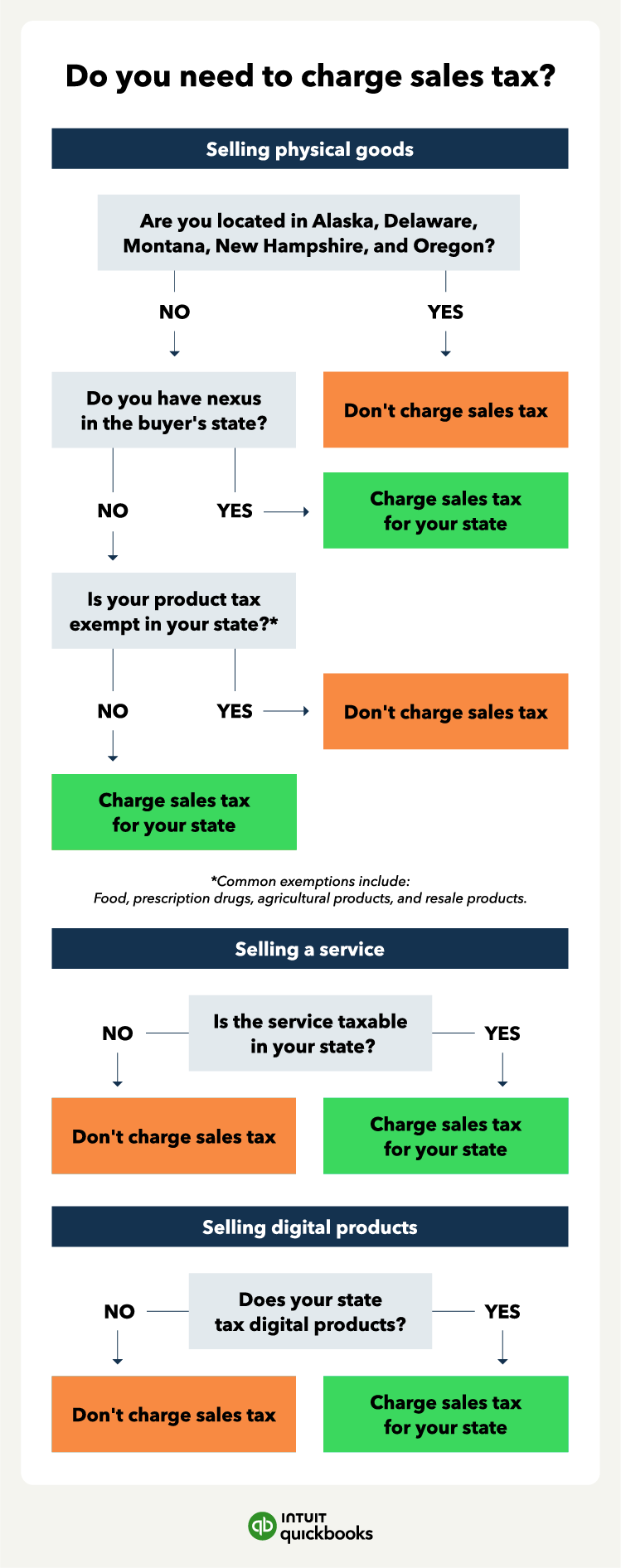

Whether or not you need to charge sales tax depends on various factors, like your business location and the type of goods or services you sell.

Most of the time, sales tax will depend on what your business offers because tax obligations differ between physical goods, services, and digital products.

Physical goodsIf you sell physical goods, you’re more than likely required to collect sales tax. According to the Tax Foundation , only five states don’t have a statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon.

So if your business location is in one of the other 45 states and you sell physical goods, you’ll need to collect sales tax from customers. However, there are also exceptions based on the type of physical goods you sell.

Each state has its own list of taxable goods. In most cases, you can find it on your State Department’s website under the Department of Revenue (sometimes called the “Department of Taxation”).

Here are some common (but not universal) exceptions to state sales taxes:

These exceptions provide a general guideline, but you’ll need to thoroughly research your state’s tax laws since they can be complex and detailed. For example, in Texas, “baked goods” such as doughnuts, bagels, and bread are exempt from sales tax. But the law explicitly excludes items like pretzels, sandwiches, or pizza from that “baked goods” classification—it’s complicated out there for a humble baker!

For a long time, sales tax applied only to tangible personal property (TPP), which are goods you can physically touch. But because the line between goods and services has become increasingly blurred, many states also apply sales tax to services.

Your business location will also play a large role in this area. Aside from the five states that don’t charge sales tax, there are also four states that apply sales tax to services by default, according to Avalara : Hawaii, New Mexico, South Dakota, and West Virginia.

The remaining 41 states might require business owners to charge sales tax on services—although plenty still don’t. Taxes will depend on the type of service they offer, so it’s best to consult an accountant for advice.

Generally, services fall into one of the following six buckets:

States will tax those categories differently or even not at all. For example, Alabama charges sales tax only for amusement and recreation services, while Virginia charges sales tax only for services to TPP.

Most religious and nonprofit organizations are exempt from sales tax. Check with an accountant or tax professional in your state to confirm whether your service-based business has a sales tax exemption.

You're never too small, and it's never too soon to know you're on track for success.

Start here Digital productsIn this digital age, sales tax laws get even trickier when talking about online sales of digital products, such as intangible products purchased and downloaded or accessed online.

This area continues to evolve, and several states haven’t yet clearly stated how they’ll charge digital products. Some states treat them like tangible personal property, while others treat them as tax-exempt.

Additionally, some states distinguish between software and digital products. Others tax differently depending on people accessing the product (whether it’s downloaded to a personal device or accessed online).

Out-of-stateConsidering there are 50 different states (each with its complex tax laws), it’s no surprise that business owners are daunted by out-of-state sales taxes.

Out-of-state sellers, also called remote sellers, generally won’t need to collect taxes from their customers unless they have a nexus within that state. Literally translated as a “connection,” a nexus means that your business meets one or more of the following criteria:

So, many online sellers can ship goods out of state without charging or collecting sales tax, provided they don’t have a physical presence in that state.

There’s one more term you might come across as you research your state tax rates: use tax , a type of excise tax . The IRS defines use tax as a tax imposed on the sale of specific goods or services or certain uses. Use tax is often used for out-of-state purchases but is generally not the seller’s responsibility. In most cases, the purchaser should declare and file this tax in their home state.

Relevant and timely resources to help you start, run, and grow your business.

Thanks for subscribing.

Fresh business resources are headed your way!

How much sales tax do I need to collect?If you sell goods in one of the 45 states with sales tax, you’re responsible for collecting and filing these taxes with your state government. Since the state tax rates fluctuate monthly, this can be a moving target.

State tax rates range from 0% up to 7.25%. For example, you can determine the exact tax rate for a specific address in your state with a sales tax calculator .

You might also be responsible for local sales tax based on the city, county, or jurisdiction in which you or your customer resides. How do you know if you should charge based on the location of your business or your customer? That depends on whether you operate in an origin-based state or a destination-based state:

Origin-based states include Arizona, California (except district taxes are destination-based), Illinois, Mississippi, Missouri, Ohio, Pennsylvania, Tennessee, Texas, Utah, and Virginia. All other states are destination-based, making it the more prevalent category.

Sales tax by stateAs we mentioned, deciding if you need to charge sales tax will depend on the type of service or product you sell and your business location. Although some states don’t impose sales taxes , others have state and local tax rates.

Here are the 2023 sales tax rules by state and the method the state uses:

How to handle sales tax paperwork and filingUnfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services.

To legally charge sales tax, you need a seller’s license or permit from your state. In some states, you'll also have to obtain a seller’s permit on a state level. In others, you'll also have to obtain a license from your city, county, or jurisdiction.

To apply for a sales tax permit, visit your State Department’s website. Look for the “sales tax” or “seller's permit” (or license) application under the Department of Revenue. You’ll use that application to submit some basic information about your business, including your location, business type, and taxes you intend to collect.

As you collect sales tax, you’ll have to remit it with a sales tax return to your state government regularly, such as monthly, quarterly, or annually. How often you remit taxes will depend on how many sales you’re making, as higher sales volume means more frequent filing.

When your state gives you your seller’s permit, they should also let you know your filing frequency. At that same time, it’s wise to ask about your sales tax due date. Most states expect business owners to file their sales tax return by the 20th of the month following the taxable period, but this date can vary .

Find peace of mind come tax timeIt’s normal if the idea of managing your sales taxes makes you chew your nails. Figuring out all of the sales tax laws and details is intimidating. The good news is that there are qualified tax professionals and accountants for small business taxes who can help you through this process so you don’t have to keep asking yourself, “Do I need to charge sales tax?”

Accounting software like QuickBooks will also track and manage your sales tax information, reporting, and filing. QuickBooks automatically does all the sales tax calculations, so you don’t have to worry about getting them wrong.

QuickBooks has the tools you need to help your business thrive.You have a nexus if your business meets one or more of the following criteria:

You’ll charge sales on items shipped out-of-state depending on the start you operate your business and whether it’s a destination or origin-based state. If your state is origin-based, the sales tax rate is based on your business's location. If your business is in a destination-based state, the sales tax rate is based on your buyer's location.

Do I have to collect sales tax for a hobby?Generally, whether you have to collect sales tax for a hobby will depend on whether you engage in the hobby for sport, for recreation, or to make a profit. However, according to the IRS , if you make money from a hobby without the intent of making a profit, you’ll still have to report the income.

Do I need to add tax to my invoice?Invoices have a space to add the sales tax on the good or service sold, but whether you add to it will depend on the state and type of item or service you sell.

Recommended for you

Internet sales tax: When do you need to collect online sales tax?

February 29, 2024

Sales tax nexus: Thresholds and rules by state

What is business accounting? 21 tips for business owners

December 3, 2020

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

**Product information

QuickBooks Live Assisted Bookkeeping: This is a monthly subscription service offering ongoing guidance on how to manage your books that you maintain full ownership and control. When you request a session with a Live Bookkeeper, they can provide guidance on topics including: bookkeeping automation, categorization, financial reports and dashboards, reconciliation, and workflow creation and management. They can also answer specific questions related to your books and your business. Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide.

QuickBooks Live Full-Service Bookkeeping: This is a combination service that includes QuickBooks Live Cleanup and QuickBooks Live Monthly Bookkeeping.

1. QuickBooks Online Advanced supports the upload of 1000 transaction lines for invoices at one time. 37% faster based off of internal tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow.

2. Access to Priority Circle and its benefits are available only to customers located in the 50 United States, including DC, who have an active, paid subscription to QuickBooks Desktop Enterprise or QuickBooks Online Advanced. Eligibility criteria may apply to certain products. When customers no longer have an active, paid subscription, they will not be eligible to receive benefits. Phone and messaging premium support is available 24/7. Support hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. holidays and events beyond our control. Intuit reserves the right to change these hours without notice. Terms, conditions, pricing, service, support options, and support team members are subject to change without notice.

3. For hours of support and how to contact support, click here.

4. With our Tax Penalty Protection: If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty, up to $25,000. Additional conditions and restrictions apply. See more information about the guarantee here: https://payroll.intuit.com/disclosure/.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Money Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Commerce Integration: QuickBooks Online and QuickBooks Commerce sold separately. Integration available.

QuickBooks Live Bookkeeping Guided Setup: The QuickBooks Live Bookkeeping Guided Setup is a one-time virtual session with a QuickBooks expert. It’s available to new QuickBooks Online monthly subscribers who are within the first 30 days of their subscription. The QuickBooks Live Bookkeeping Guided Setup service includes: providing the customer with instructions on how to set up chart of accounts; customized invoices and setup reminders; connecting bank accounts and credit cards. The QuickBooks Live Bookkeeping Guided Setup is not available for QuickBooks trial and QuickBooks Self Employed offerings, and does not include desktop migration, Payroll setup or services. Your expert will only guide the process of setting up a QuickBooks Online account. Terms, conditions, pricing, special features, and service and support options subject to change without notice.