- Select whether you would like to allow the school to use loan funds to pay for other charges (library fines, lab fees, health charges at McKinley etc.).

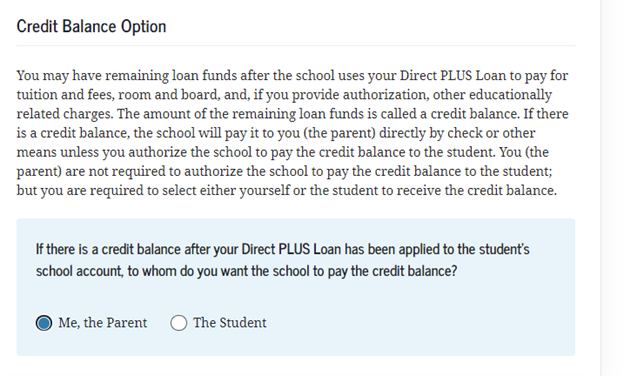

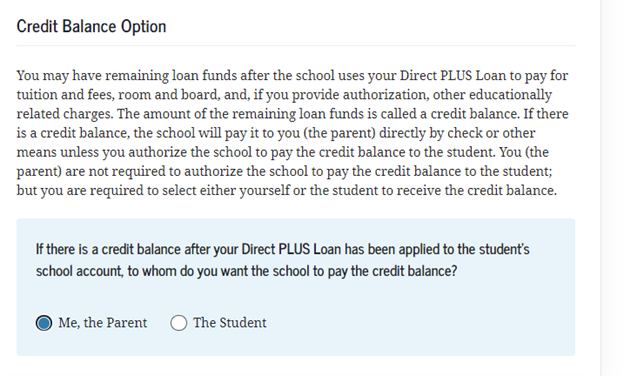

- Select how you would like to have any excess credit balances to be handled.

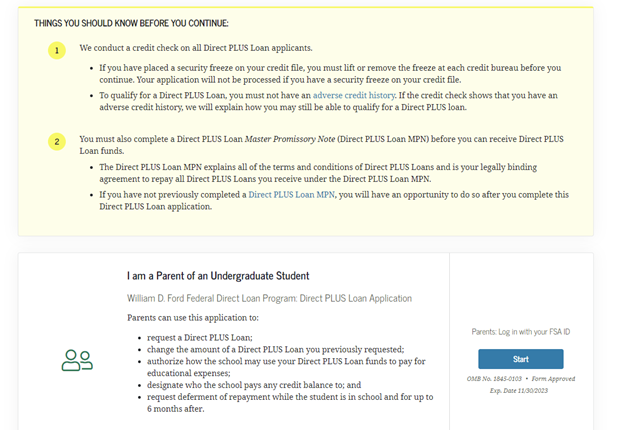

- Complete each page of the application process until you come to a Congratulations page indicating that you’ve completed the loan request and whether or not the credit has been approved.

- If the loan is approved and you would like to continue with the process, click the “Complete Loan Agreement (Master Promissory Note)” link in the center of your Dashboard. If you have completed an MPN for this same student and did not have an endorser on the previous MPN, you do not need to complete this step.

- Make sure to enter all required information and click “Submit” at the end of the MPN to ensure the information is electronically submitted.

- The Office of Student Financial Aid will then certify borrower eligibility with the Direct Loan Servicer. This certification process begins around June 1 each year.

- If the PLUS loan was denied, you have 3 options:

- You may get an endorser for the loan

- You may appeal the decision

- The student can seek an additional unsubsidized loan for the academic year, and must make this request on their Financial Aid Notification via the “Request Changes” option at the bottom of their notification

Receipt of Funds & Refunds

If credit is approved and an MPN has been completed, loan funds will begin to be disbursed one week before classes begin. The funds will be applied to tuition, fees, and other university charges, and any extra money will be refunded to either the student or parent, depending on what was indicated on the application. If the PLUS Loan process isn’t completed by the first disbursement, subsequent disbursements are scheduled twice a week up until the last week of each semester.

Application Denial

If a Federal Direct Parent PLUS Loan application is denied, the borrower may obtain a qualified endorser or it may be possible for a student to borrow an additional amount of unsubsidized loan. In this case, the dependent student’s annual maximum allowable loan limit will be replaced by the independent student maximum allowable loan limit at the same class level. If the application is denied, the student should access their Financial Aid Notification, select “Request Changes,” and ask to be re-packaged for additional unsubsidized loan funds.

Repayment

Repayment begins within 60 days of the final loan disbursement during the academic year. Principal and interest payments may be deferred if the borrower meets deferment requirements. In-school deferments may be requested by parent borrowers provided the student is enrolled at least half time in a degree-seeking program.

To learn more about available deferments and how to apply for deferment status, please contact your loan servicer. To find out which lender is servicing your loan, visit the National Student Loan Data System, log in using the parent borrower’s information, and select the number next to each loan for contact information.